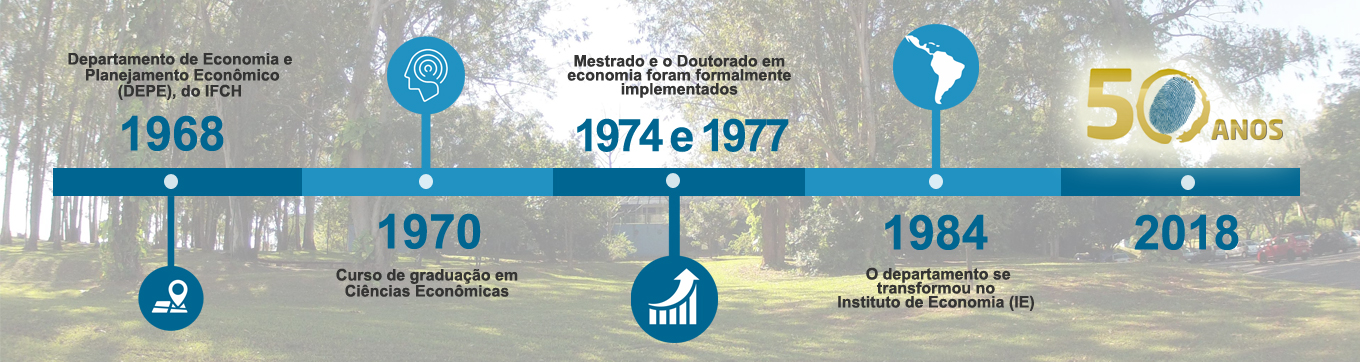

O curso em sete aulas foi realizado de 7 a 15 de agosto de 2018 como parte das comemorações dos 50 anos do Instituto de Economia da Unicamp.

Nessa série de vídeos o prof. L. Randall Wray, do Levy Economics Institute (EUA), fez uma apresentação abrangente da Modern Money Theory, partindo dos fundamentos teóricos e chegando a uma análise das questões do capitalismo contemporâneo. Além do curso completo, também estão disponíveis as apresentações em PPT e a bibliografia usadas em cada uma das aulas. Para ter acesso, clique no vídeo da respectiva aula no Youtube e veja a descrição. Abaixo um breve relato sobre as aulas:

Acesse a playlist completa no YouTube

LECTURE 1 – AN INTRODUCTION TO MODERN MONEY THEORY (August 7th, Minsk2018)

In this lecture, that is the first one in the Course of Modern Money Theory, Professor L. Randall Wray presents an overview of this theory and deals with the following topics: 1) the origins and nature of Money; 2) the role of the State; 3) the role of taxes; 4) sovereign currency and 5) can government run out of Money? According to the answers he gives to these questions, Professor Wray concludes that the only economic constraint government faces are full employment of resources and inflation. All the other constraints are political.

LECTURE 2 – ENDOGENOUS X EXOGENOUS MONEY (Institute of Economics, Campinas, Unicamp, August 8th, 2018)

In this lecture, that is the second of the Course of Modern Money Theory, Professor L. Randall Wray discusses the endogenous Money approach, that is part of Modern Money Theory, and explains how it opposes to the idea that the supply of money is controlled by Central Banks (exogenous Money approach). In order to do that, he goes in detail about the creation of Money and the actual role of the Governments, of the banking systems and of the Central Banks in this process.

Assista no YouTube: https://youtu.be/-O5BJSv3btU

Apresentação PPT: https://goo.gl/w8ruh6

LECTURE 3 – MODERN MONEY THEORY (August 9th, 2018)

In this lecture, that is the third of the Course of Modern Money Theory, Professor L. Randall Wray goes in detail into Modern Money Theory, and deals with the main criticisms to this approach. His starting point is the idea of Tax Driven Money, meaning that government spends first, and then collects taxes. Given that, he goes in detail about monetary and fiscal policy and how the Treasuries and Central Banks operate in modern economies. Taking that, he faces the question: which are the constraints to the functioning of modern economies?

Assista no YouTube: https://youtu.be/WfF4peuP6EI

Apresentação PPT: https://goo.gl/YjJ6xf

LECTURE 4 – FULL EMPLOYMENT THROUGH THE JOB GUARANTEE (August 13th , 2018)

In this lecture, that is the fourth of the Course of Modern Money Theory, Professor L. Randall Wray deals with the issue of unemployment. He discusses its causes, based on Minsky’s original reflections on this subject, and criticizes the traditional Keynesian approach. The Job Guarantee policy, a direct approach to deal with unemployment, is fully assessed, and Professor Wray presents in detail the recent proposals for USA presented by a group of researchers at the Levy Economics Institute.

Assista no YouTube: https://youtu.be/PAF8_fSkhzg

Apresentação PPT: https://goo.gl/Rq5MLu

LECTURE 5 - MINSKY’s MODERN MONEY THEORY (MMT) AND FUNCTIONAL FINANCE (August 14th, 2018)

In the fifth section of the Modern Money Theory Course, Professor L. Randall Wray goes back and tracks the Minskyan routes of MMT and his connections with Abba Lerner’s principles of Functional Finance. Coming from this perspective, the main argument of MMT is that fiscal policy primary target might be full employment without high inflation. And also argues why a typical general aggregate demand stimulus does not generate full employment and leads to effects ranging from increasing financial fragility, inflation and inequality.

Assista no YouTube: https://youtu.be/jFk6zxxAXIs

Apresentação PPT: https://goo.gl/AA8t95

LECTURE 6 - MINSKY AND FINANCIAL KEYNESIANISM (August 155h, 2018)

In this lecture, the sixth oh the Modern Money Theory Course, Professor L. Randall Wray goes back to Minsky’s early contributions, including his concerns with poverty and unemployment and his critique to the traditional Keynesian approach. The Financial Instability Hypothesis is presented as Minsky’s main critique of financial capitalism. Professor Wray also discusses Minsky’s stages approach of capitalist economies, and finally points out some policies that, according to this view, could help promote stability.

Assista no YouTube: https://youtu.be/VAGqM5D0Vdc

Apresentação PPT: https://goo.gl/4hR2V7

LECTURE 7 – THE RISE OF MONEY MANAGER CAPITALISM AND THE GLOBAL FINANCIAL CRISES (August 165h, 2018)

In this lecture, the last one of the Modern Money Theory Course, Professor L. Randall Wray discusses the main characteristics of contemporary Money Manager Capitalism and the road that lead to the 2008 financial crisis. He also analyses the Euro Crisis from the perspective of Modern Money Theory, stating that the main problem is that member states abandoned sovereign currency. At the end of the lecture some policy options are assessed.

Assista no YouTube: https://youtu.be/hpRawMUQJdc

Apresentação PPT: https://goo.gl/Uq7mso

English

English

O Instituto de Economia da UNICAMP foi criado em 1984 e tem por finalidade a promoção do ensino e da pesquisa na área de Economia.

O Instituto de Economia da UNICAMP foi criado em 1984 e tem por finalidade a promoção do ensino e da pesquisa na área de Economia.